Sage Business Cloud Accounting Review

By BizBritain

By BizBritain

almost 7 years ago

read

In this review we’ll be exploring Sage Business Cloud Accounting (formerly Sage One), an accounting software package that’s aimed at the accounting and bookkeeping needs of startups, small businesses and sole traders.

Sage are a global accounting software and business services company based here in the UK who offer a number of accounting and business software solutions. The company was originally founded in 1981, and now employs 13,000 people, supporting millions of entrepreneurs across 23 countries.

Sage are a global accounting software and business services company based here in the UK who offer a number of accounting and business software solutions. The company was originally founded in 1981, and now employs 13,000 people, supporting millions of entrepreneurs across 23 countries.

Who's if for

Sage Business Cloud Accounting is best suited for smaller sized business. It would work very well as as a solution for sole traders and "solopreneurs", but could also handle the needs of small businesses with higher turnover, and teams of employees.

Ease of use

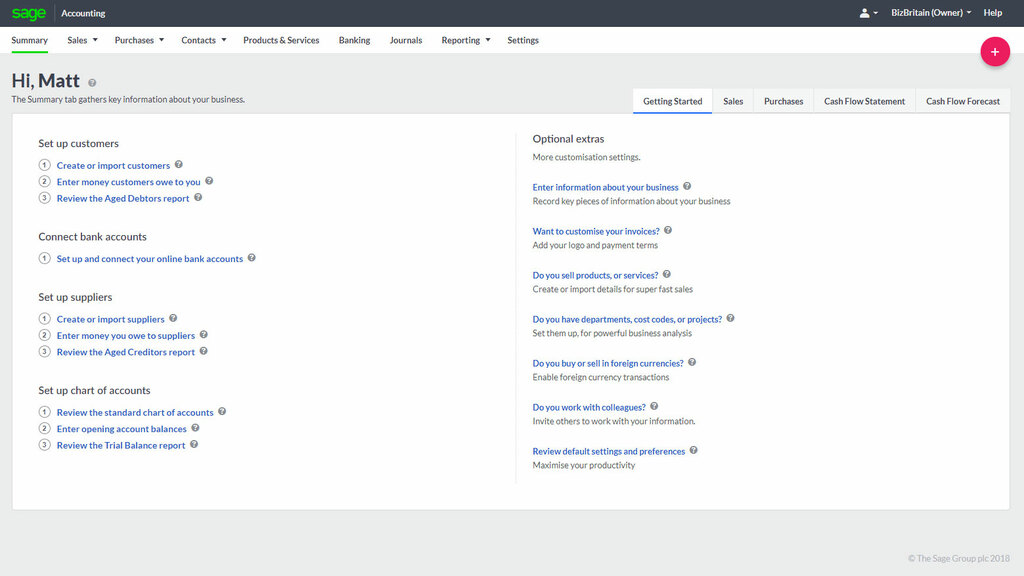

Setting up the account was nice and simple, and only took a couple of minutes. There are clear prompts on what needed to be done, which is as simple as just supplying some basic information about your business, such as its name, location and tax details.

Once set up, the overall interface of the software is very clean and simple. Upon logging in, you are directed to a summary page from where you can perform key functions such as setting up customers/suppliers, linking bank accounts, and accessing the various different sections of the app via a menu bar across the top of the page. These sections are broken down into:

* Sales

* Purchases

* Contacts

* Products and services

* Banking

* Journals

* Reporting

The simple and uncomplicated navigation options make it very easy for the user to understand what does what. It all feels very intuitive, and free from “finance jargon”.

Functionality

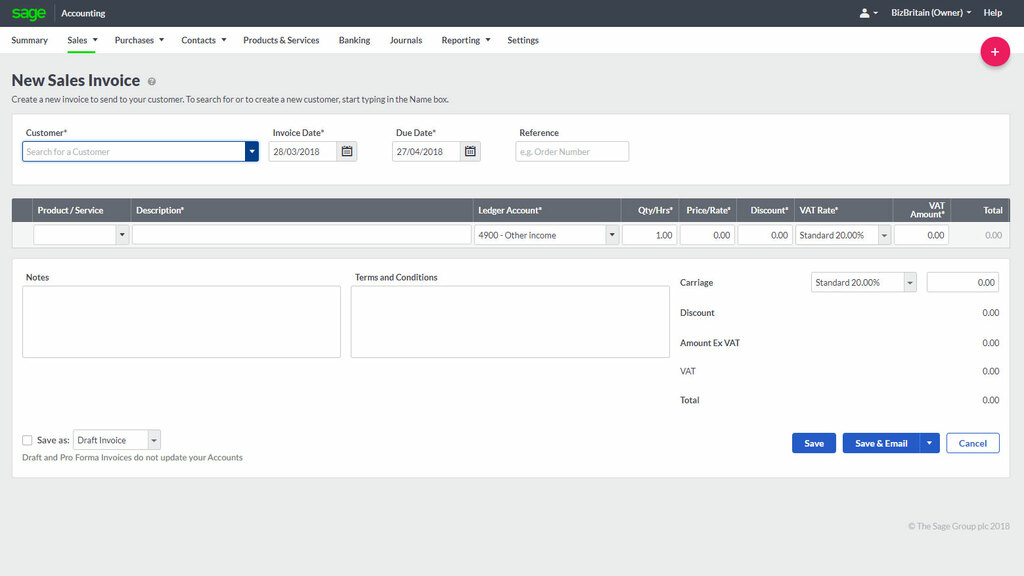

Sage Business Cloud Accounting includes all the basic functionality you would expect from an accounting package. You can produce quotes, sales invoice, and credit notes, you can input purchase invoices, and you can carry out journal entries.

You are also able to connect your bank account directly to the software, so that all of your transactions are automatically imported. This means that you save a great deal of time on data entry tasks, and helps avoid mistakes arising from manually typing in transactions from your bank statement.

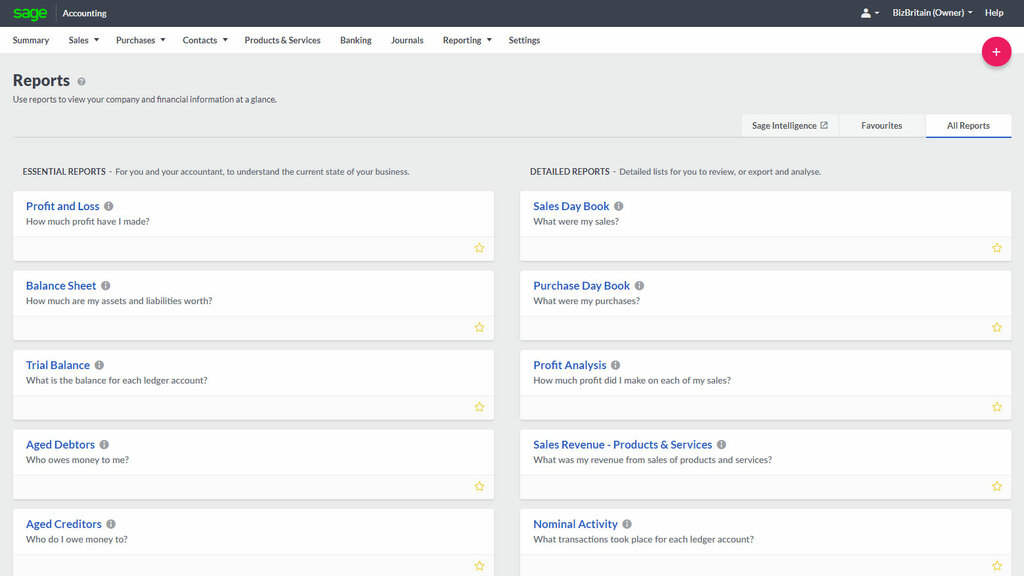

Finally, you are able to instantly display a multitude of key reports including your trial balance, VAT returns, balance sheet, profit and loss, aged debtors and more. All the reports are displayed very clearly in a logical sections.

Value for money

Sage Business Cloud has two versions; they are called Accounting Start, and Accounting. There is also a payroll package which can be added separately.

Accounting start is aimed at sole traders and freelancers, and starts at a very reasonable £3 per month. This takes into account a 50% discount which users are given for the first 3 months, after which point the price is £6 per month.

Accounting is aimed at limited companies and small businesses which have grown beyond a “one man band”. The pricing for this version starts at £10 per month. Once again this takes into account a 50% discount for the first 3 months. The full price after that is £20 per month.

The payroll add-on can be purchased from £3 per month, and allows you to manage payroll for up to 25 employees.

It’s also well worth noting that there’s a 30 day trial available for each version, so you can take it for test drive before committing.

All in all Sage Business Cloud is very competitive from a pricing standpoint.

Summary

Overall, Sage Business Cloud Accounting does what it says on the tin. It offers a simple, easy to use cloud based accounting system for sole traders and small businesses. It’s a relatively basic product, but it ticks all the essential boxes for the type of businesses it’s targeted at. So if you’re looking for a no-frills solution at a good price, this could be a good option for your small business to consider. At the very least it’s definitely worth exploring the 30 day free trial.

.jpg)

.jpg)