3 Things Investors Look For In a Business

By BizBritain

By BizBritain

about 1 year ago

read

Starting and running a business can be expensive, and only a few get off the ground or keep going without outside financial help. There are several options for those who need a cash injection, including loans and borrowing from friends and family. You can also source funds from investors, but you must know what investors look for beforehand.

A Great Management Team

It might be surprising to learn that you and your team are one of the most significant determinants of whether you acquire an investment. Investors know businesses are built on a robust foundation of the right people. They also know the work they have done in the past and continue to do, skills, experience, and drive to ensure the business succeeds have been crucial to getting it to where it is.

Charisma will only get you so far, but a strong team of the right people will give them a reason to look at your proposal or business plan. Do everything you can to show an investor you are the right team to invest in, and they might agree.

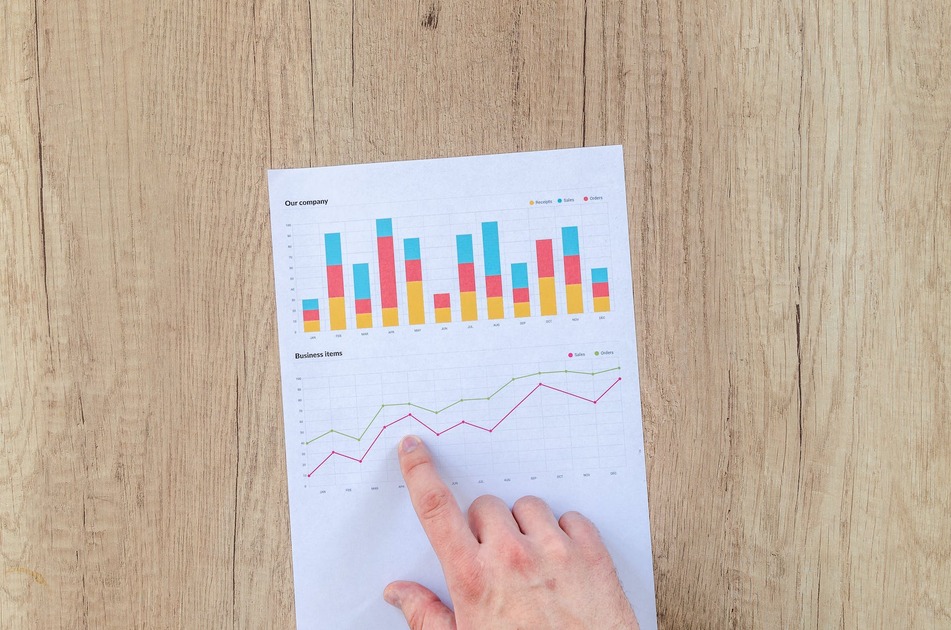

Strong Past Performance data

While past performance is never an indicator of future outcomes, a strong past performance shows investors they are likely to have a great return on their investment. If you can show the business is already making money, you are doing much better than most at making an investor confident in it.

Investors will want to see your gross margin, the difference between revenue and cost of sold goods. This number tells investors how much profit to expect before accounting for administrative and other costs.

They will also want to see your revenue growth, the percentage difference in your revenue now versus the same period last month or year. However, they can ask you to calculate it for any period depending on how long the business has existed.

Other important numbers include:

● Net income - The amount left after accounting for all expenses

● The Monthly recurring revenue

● Churn rate - The rate a business loses customers

● Customer acquisition

● Revenue per employee

● Liquidity

A Unique Idea

Businesses doing the same thing as others are unlikely to be a huge hit. What unique idea do you have that can become a runaway success? You should expect your investors to ask you questions like these.

Be ready to explain to investors why your product or service is unique, why it stands out, and why people are excited about it. Also, they will require you to explain the unique problem it solves or the needs it meets.

If your product is unique enough with a unique market segment and customer base, and you are a big global billion-pound business, you might already be doing well enough to attract the interest of Parabellum Investments, a global family office. Companies like these are interested in the next billion-dollar idea and business, and yours might be a good fit if you have something unique that no one else is offering.

There is a lot more that goes into getting investors interested in your business. However, starting strongly in the areas discussed above is a great place to start. Then, work on demonstrating your business model, spending plan, how much market you have captured, and your valuation so they know their investment is secure.

.jpg)

.jpg)